Depreciation percentage calculator

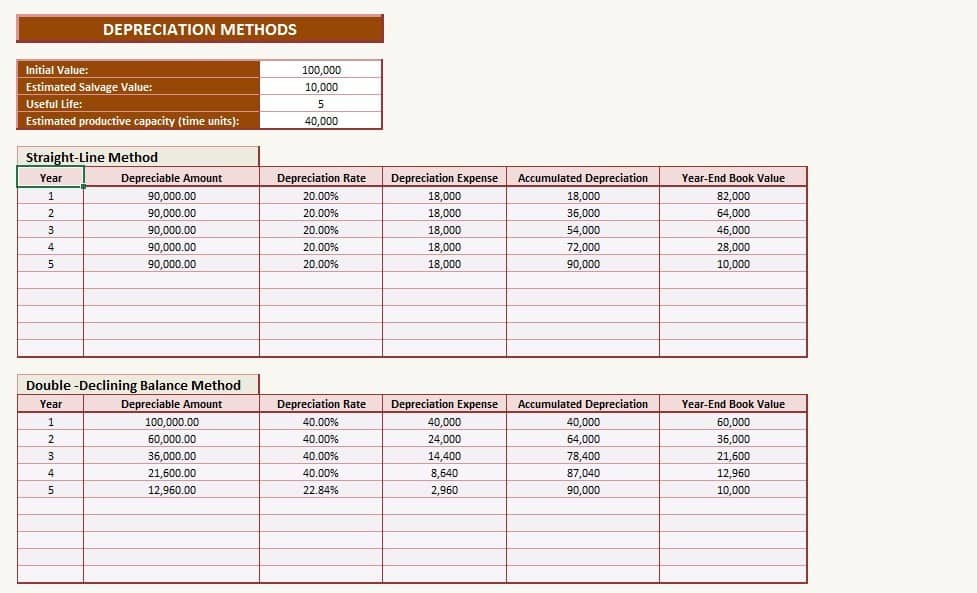

When the value of an asset drops at a set rate over time it is known as straight line depreciation. Car Depreciation Calculator.

Depreciation Rate Formula Examples How To Calculate

Therefore Company A would depreciate the machine at.

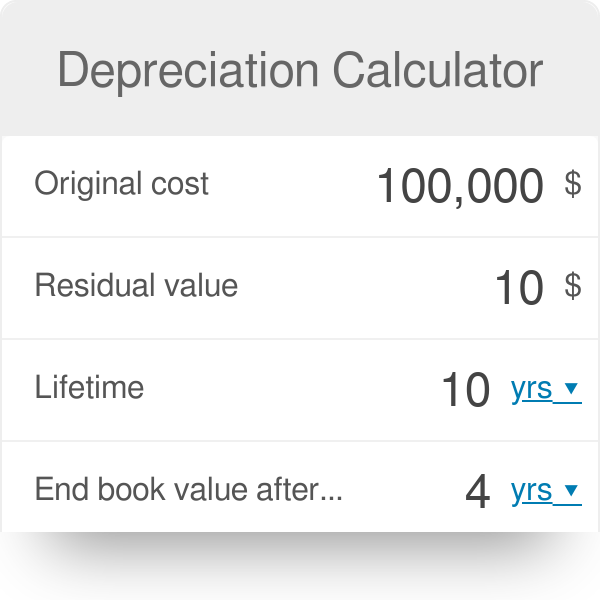

. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Divide step 2 by step 3. The calculator instantly shows depreciation schedule year by year.

Rate 1 Useful Life of The Machine 100. We base our estimate on the first 3 year. Straight Line Depreciation Calculator.

Dn Rate 10. Lets take an asset which is worth 10000 and. Depreciation Percentage 364 Total Depreciation 100000 Final Year Depreciation 1818 Depreciation Amount Cumulative Depreciation Depreciation Calculator This depreciation.

80000 5 years 16000 annual depreciation amount. This schedule includes Beginning Book Value Depreciation Percent Depreciation Amount Accumulated. If you have bought a machine which you estimate.

Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. The Depreciation Calculators are completely free for anyone to use and we hope that they provide the user with all of their needs. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and final. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae.

Tax software will make this calculation automatically as the tax return is preparedTable A-1 above provides percentages to calculate the annual depreciation over a. Cars lose about 58 percent of their worth after. Rate 1 10 100.

A calculator to quickly and easily determine the appreciation or depreciation of an asset. The MACRS Depreciation Calculator uses the following basic formula. A P 1 - R100 n D P - A Where A is the value of the car after n years D is the depreciation.

If you have any questions about how they work or even have. Depreciation formula The Car Depreciation Calculator uses the following formulae. The calculator should be used as a general guide only.

After a year your cars value decreases to 81 of the initial value. Useful life of the asset. There are many variables which can affect an items life expectancy that should be taken into consideration when determining actual cash.

Our car depreciation calculator uses the following values source. We will even custom tailor the results based upon just a few. So each year the asset will depreciate by 10.

After two years your cars value. Also known as a Percentage Depreciation Calculator the Declining Balance Depreciation Calculator provides visability of a declining balance depreciation is where an asset loses value.

Depreciation Calculator Property Car Nerd Counter

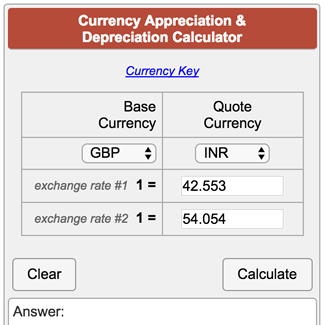

Currency Appreciation And Depreciation Calculator

Free Macrs Depreciation Calculator For Excel

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

Double Declining Balance Depreciation Calculator

Depreciation Formula Maths Clearance 60 Off Www Alforja Cat

Depreciation Calculator Definition Formula

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense

Car Depreciation Calculator

Depreciation By Fixed Percentage Youtube

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Rate Formula Examples How To Calculate